Asian Consulting Group takes the helm to address Global and Local Tax Challenges

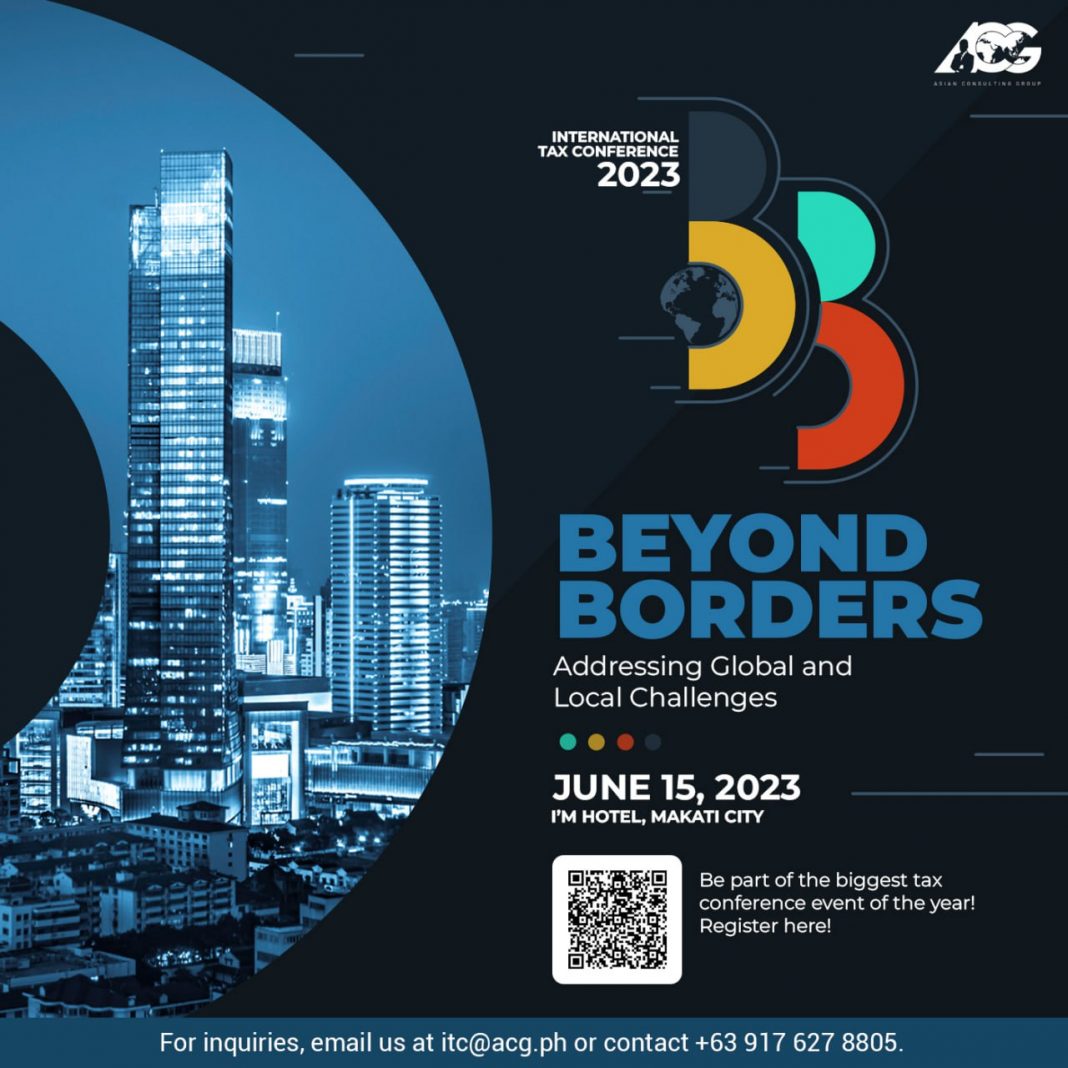

The Asian Consulting Group (ACG), esteemed for its exceptional tax consultancy services for leading corporations, SMEs, and public figures within the Asia-Pacific region, is gearing up to host the prestigious International Tax Conference in the Philippines. Scheduled for June 15th at the IM Hotel in Makati City, the event marks the successful culmination of the International Roadshow 2023. This notable initiative has been realized through a collaborative effort between ACG and the Center for Strategic Reforms of the Philippines, alongside an array of esteemed international and local business organizations and foreign chambers.

The International Tax Conference aims to address crucial topics, including global tax issues, sustainability, and digitalization. It provides a robust platform for leaders, executives, and influential figures from the corporate and governmental sectors to engage in meaningful discussions.

“As our economy undergoes swift transformations and growth, grasping the complexity of tax regulations has become a fundamental necessity. The International Tax Conference has been meticulously designed to empower Filipino professionals with the critical knowledge and acumen required to proficiently navigate this dynamic landscape effectively,” says Mon Abrea, Chairman and CEO of Asian Consulting Group.

Hosted by multi-awarded journalist Rico Hizon, some of the conference’s key speakers include representatives from The World Bank, Asian Development Bank, International Monetary Fund, United Nations Office on Drugs and Crime, OECD, Department of Budget and Management, and the Senate of the Philippines.

For those keen to broaden their understanding of the Philippine tax framework and forge meaningful connections with industry leaders, the International Tax Conference on June 15th at the IM Hotel, Makati, presents an unparalleled opportunity. Additional information is readily available on the ACG website at https://www.acg.ph. Inquiries can also be directed via email to itc@acg.ph or via mobile at +63 917 627 8805.

Originally published on THEPHILBIZNEWS.